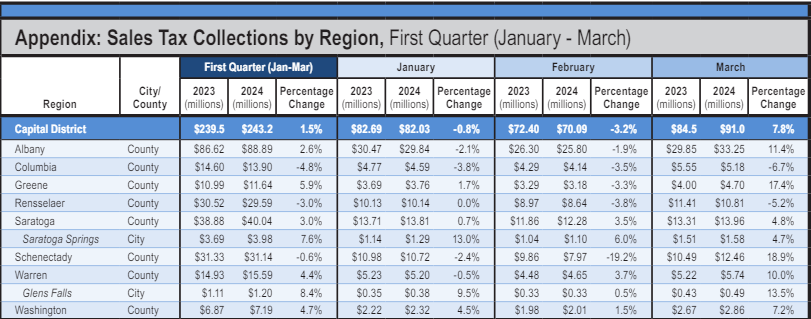

ALBANY — Sales tax collection in Columbia County in the first quarter of 2024 totaled $13.9 million, a 4.8% decrease from the previous year, according to a report from state Comptroller Thomas P. DiNapoli.

Within the Capital District region covered by the report, which included eight counties and two cities, the city of Glens Falls had the highest rate of growth of 8.4%.

Columbia County saw the largest decrease in sales tax collection, at 4.8%, while Greene County had a 5.9% increase, totaling $11.6 million.

“We have seen a lot of growth in Greene County,” said Pamela Geskie, president and executive director of the Greene County Chamber of Commerce. “There’s been a lot of positive feedback from business owners on the growth.”

The sales tax increase indicates the encouraging things happening throughout the county, Geskie said.

“This increase shows the positive energy that’s going on in all of Greene County,” she said. “People are out shopping, are out dining, and it’s encouraging.”

In Columbia County, sales tax collections are down $700,000 compared to 2023, said Matt Murell, chairman of the Columbia County Board of Supervisors.

“It’s something we’ve been monitoring,” he said. “We’re hoping it turns around, but if it doesn’t we’re going to come up with strategies to deal with it.”

The county is looking into the cause of the decrease, Murell said.

“We’re trying to put our finger on it,” he said. “It could be a combination of factors, such as car sales or the service industry decreasing. We’re trying to track that and figure that out. If that is the case there’s not a lot we can do to turn that around,”

The decrease could also be due to more people shopping in department stores, Murell said.

“It could be that people are returning back to the box stores (out of the county),” he said. “Where people were shopping online previously, now they’re not, or not as much.”

Local sales tax collection statewide totaled $5.6 billion, a $87.3 million or 1.6% increase, and was the lowest rate of growth since 2021, according to the report.

The growth was mainly driven by New York City, which saw a $79.4 million, or 3.2% increase compared to 2023, according to the report. New York City accounted for over 45% of sales tax collection in the state, returning to its 2019 levels after a decrease in 2020 and 2021.

Sales tax growth in New York City reflects the recovery of the tourism industry since the pandemic began four years ago, according to the report.

“Local sales tax collections in the first quarter showed modest year-over-year growth, led by New York City and its resurgent hospitality industry,” DiNapoli said in a statement. “The numbers from the city signal a healthy tax base and a return to its pre-pandemic role as a major driver of sales tax growth in the state. Collections outside the city were relatively flat, resulting from a variety of economic influences.”

Overall sales tax growth could be the result of multiple things, including inflation. The increased cost of taxable items, such as goods sold at restaurants, cars, or other merchandise, can make collections increase, as long as consumption of those items is not impacted, according to the report.

In June 2022, the rate of inflation in the U.S. was 9.1%, and decreased to 3.0% in June 2023. The rate of inflation in March of this year was 3.5%, according to the most recent data released by the U.S. Bureau of Labor Statistics.

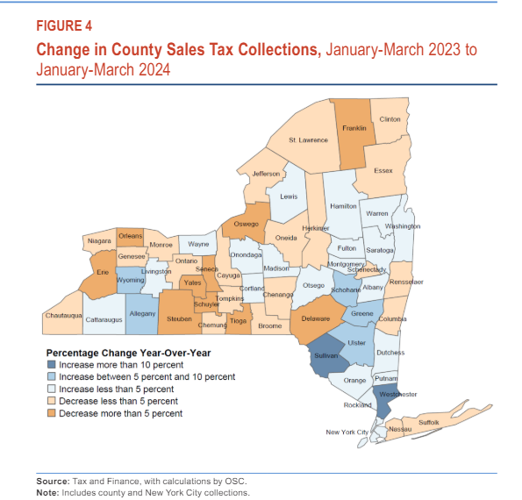

More than half of the counties outside of New York City experienced decreases in their sales tax growth, with Yates and Franklin counties experiencing the largest decline of 7.1% and 6.8%, respectively, according to the report.

“Throughout New York state, it’s down,” Murell said. “Other counties are also experiencing lower sales tax.”

There is not one answer for why sales tax collection decreased in the county, Murell said.

“We’re planning for the worst and hoping for the best,” he said. “We’ll see where we are in the second quarter and then move forward from there, if we have to.”